Welcome toConsumer-Controlled,

CommerceTM

Consumer-Controlled CommerceTM (CCC)

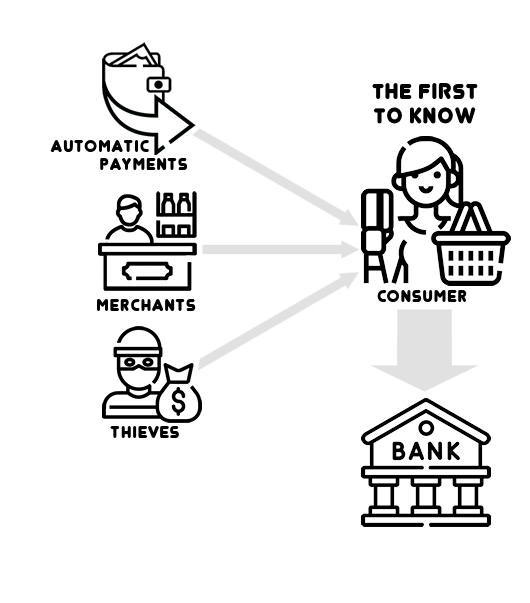

Assumed Authority

A backwards process

Whenever a bank receives a payment request, it is under the assumption that the consumer gave their explicit authority. Very little if any attempt is made by the bank to verify the validity of the claim. Every request for payment looks the same to the bank, which explains why there is over 30,000,000,000 (30 billion) in fraud annually. It seems rather incredulous that banks act on so flimsy authority.

Of course, it is the consumer's responsibility to police their accounts and notify the bank of their errors, a process that can take several days to weeks. In the end, and from the bank's perspective, it is the consumer's word against the seller's.

It is also assumed that it is the merchant or seller's responsibility to positively identify the consumer and verify every card swipe. Therefore, merchants are subject to charge backs and other penalties. The Assumed Authority problem ends up hurting everyone in direct losses, higher prices and higher interest rates.

Direct Authority

Every request for payment is presented to the consumer, a type of purchase offer. If accepted, the consumer notifies their bank of the transfer of funds. Since the request came directly from the consumer, there is no more assuming. Every potential transaction gets presented to the consumer for validation. This is the end for the vast majority of all card fraud.

Merchants no longer have any liability in accepting card payments. Not only are they protected from charge backs, but all the liability for handling and storing card data. Merchants no longer even touch card data, ever.

The only party Consumer-Controlled Commerce negativily effects is the thief. The hayday of batch processing fraudulent transactions is now over.

Revolutionary Opportunities

With the fraud problem fixed, Consumer-Controlled Commerce provides several very powerful features for both consumers and merchants!

Unmatched Privacy

Because the merchant or seller does not see any card data, a purchase can be as anonymous as cash.

The Push SaleTM

Never read your card number over the phone again. Merchants push the offer to your phone and you touch to accept.

One-Touch PurchaseTM

No more click-through statistics. Consumers can complete a purchase without having to vist your store.

Anywhere CommerceTM

Sales can now happen anywhere, from a tv, poster, mailer, business card, billboard; anywhere you advertise.

Purchase FreedomTM

With the Kubera Card, you can buy anything. If the product or service is legal in the local juristiction, you can use the card to buy it.

Consumer CartTM

The consumer now owns the cart. Merchants can place their products into them, creating endless opportunities!

Kubera Platform

The Consumer App

The Consumer App empowers consumers to make One-Touch Purchases and receive Push Sales. The wallet can hold an unlimited number of cards, where no actual card data is stored on the device.

The Merchant Kiosk

The Merchant Kiosk and online portal (not shown) provides all the tools for merchants to facilitate Push Sales and One-Touch Purchases. Merchants can also process traditional transactions and run reports.

The Kubera Card

The Kubera Card is a new credit/debit card brand and can be used to purchase anything. If it's legal locally, you can use the Kubera Card to buy it. Financial institutions can also issue the Kubera card for both credit and debit.

Become a part of this powerful new technology

Network Error Encountered

Something went wrong between your device and our servers. This is not due to anything you have done nor the information you submitted. The only thing we can do is make sure your local network is up and running and try again. If you continue to see this error, please contact us: hello@kuberanetwork.com